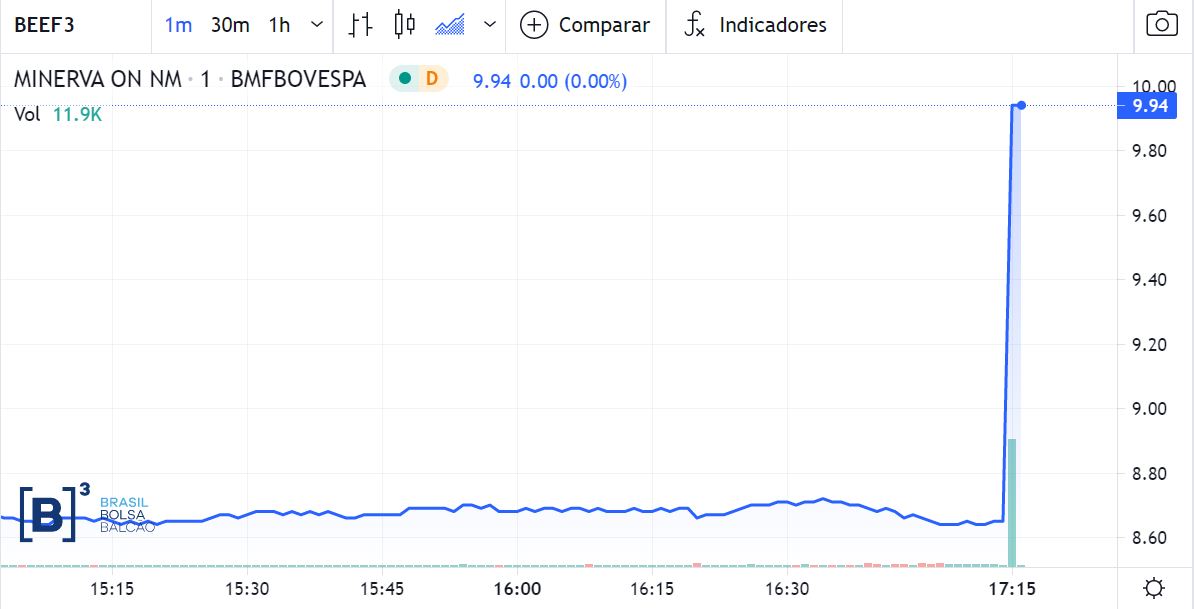

São Paulo – Minerva Foods Procedures (BEEF3) was the end of an unusual session this Wednesday (11). At the closing auction, shares jumped, closing up R$14.65, to R$9.94.

The move was made after the pipeline columnist at Valor Econômico found that the company’s controllers began discussing the possibility of closing the company’s capital.

The deal would benefit from an implicit discount that shareholders see in a company that has been regularly generating cash.

The matter has not yet reached the Minerva Board of Directors, but it has already entered the agenda of the previous committee of monitors, as stated in the post.

Through a shareholder agreement, VDQ – the ownership of the Vilela de Queiroz family – and Saudi director Salic control Minerva with 51% of the capital.

According to an analysis obtained by the report, the operation could cost about 3 billion R$. With these calculations in mind, Minerva’s watchdogs will call for a public tender offer (OPA) to be cancelled at R$12 per share. This, with respect to Tuesday’s close, at R$8.67, would represent a value of 38.4% higher and 14.6% after Wednesday’s close. In 2019, before the pandemic, the shares were worth over R$14.61.5% after the closing date.

Before buying a chip at BRF (BRFS3), Marfrige (MRFG3) up to VDQ with an offer of R$11, as the post highlights.

Edison Tequel, Minerva’s chief financial officer, replied in a note to Pipeline, when contacted by the column. “We don’t comment on rumours. We are always looking for opportunities to generate value, particularly through market equilibrium. There is clearly a huge opportunity in Minerva’s actions due to the market’s shallowness and short-sightedness regarding the company’s results, and this can clearly awaken our creativity in Looking for more complex and unusual structures to extract value from this asymmetry,” he said.

He also highlighted: “We always look at everything, take care of every possible scenario, but today there is absolutely nothing concrete to share.”

Minerva released its results for the second quarter of 2021 last Monday (9), posting a net profit of R$116.7 million, down 54% compared to the same period last year.

The company’s EBITDA (Ebitda, its English acronym) was R$544.9 million in the period, indented by 7.7% in the same comparison. The company’s net revenue was R$6.28 billion in the second quarter, up 42.9% year-on-year.

Market analysts highlighted that despite the strong numbers presented, Minerva was unable to maintain profit margins at the levels seen in the second quarter of last year. This time, they were punished by the high cost of livestock, especially in the Brazilian territory. Check out the review Click here.

In the Free Options course, Professor Su Chong Wei teaches a method for making frequent gains in the stock market. Register for free and subscribe.

Related

“Music fanatic. Very humble explorer. Analyst. Travel fanatic. Extreme television teacher. Gamer.”

More Stories

Do you use a Petrobras CNG truck? Understand the picture that became a meme

New strategy to get rid of telemarketing calls; Learn it!

Itaú will launch receivable tokens in 2022